Every dollar of contribution margin goes directly to paying for fixed costs; once all fixed costs have been paid for, every dollar of contribution margin contributes to profit. In accounting, it is crucial to distinguish between direct and indirect variable costs to ensure accurate costing of products and services, and to make informed business decisions. By understanding how variable costs impact various industries, businesses can effectively manage expenses and implement strategies to reduce costs, thereby increasing profitability.

Are direct costs fixed and indirect costs variable?

In short, fixed costs are more risky, generate a greater degree of leverage, and leave the company with greater upside potential. On the other hand, variable costs are safer, generate less leverage, and leave the company with a smaller upside potential. If a business increases production or decreases production, rent will stay exactly the same. Although fixed costs can change over a period of time, the change will not be related to production, and as such, fixed costs are viewed as long-term costs. Examples of fixed costs are rent, employee salaries, insurance, and office supplies.

Variable costs (aka variable expenses)

You should strive to keep variable cost per unit as low as possible since this will result in more profit per unit. But if your total variable costs are rising, you are producing more units—hopefully at a net profit. This is because variable costs are tied to the total quantity of units you produce. For example, if you produce 1 chair with a variable cost per unit of $50, your total variable costs would increase to $500 if you produced 10 chairs. Lastly, variable cost analysis is useful when determining your company’s expense structure.

Examples of fixed costs for restaurants

- By understanding marginal cost, businesses can make informed choices in areas such as pricing strategies and production levels.

- Items that are not direct costs are pooled and allocated based on cost drivers.

- For example, the cost of a mobile data plan might have a fixed base charge and a variable cost per gigabyte of data used.

- If your company offers shipping to customers, you’ll need to consider packaging and shipping among your other variable costs.

Direct costs and variable costs are similar in nature and are both types of costs involved in production. Direct costs are expenses that can be directly traced to a product, while variable costs vary with the level of production output. They have both a fixed component that remains constant no matter the production level and a variable component that changes with the production or sales volume. For example, the cost of a mobile data plan might have a fixed base charge and a variable cost per gigabyte of data used. On the other hand, a low operating leverage means that the company’s expenses are primarily variable costs, implying less sensitivity to changes in sales.

Accounting Close Explained: A Comprehensive Guide to the Process

Last but not least, operating expenses are variable costs that go to supporting a business’s day-to-day operations. More operation means higher expenses in areas like utilities, leases, or shipping costs. A key characteristic of operating expenses is their variable nature – they fluctuate according to the level of business operations. For instance, in a delivery service company, fuel costs would be an operating expense, changing along with the number of deliveries made.

In this guide, we’ll break down everything you need to know about variable costs. A variable cost is a type of corporate expense that changes depending on how much (or how little) your company produces or sells. Depending on how your sales or production rates are going, your variable costs can rise or fall—hence the name. Variable and fixed costs play into the degree of operating leverage a company has.

To determine total variable cost, simply multiply the cost per unit with the number of units produced. When you calculate your gross margin, net income, and net profit margin, you’ll need to factor your variable and fixed expenses into the formulas. Good variable expense analysis ensures you can calculate how scaling production up or down will impact the company’s bottom line. If the chair company knows it costs $50 per unit in variable costs to produce a single chair, it wouldn’t make sense to price the chair any lower than $51, since you would lose money on each sale.

Indirect tax, or taxes applied to all products equally, includes things like GST and VAT. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Effective management involves implementing lean techniques, negotiating with suppliers, optimizing processes, and considering material substitution.

Therefore, a company can use average variable costing to analyze the most efficient point of manufacturing by calculating when to shut down production in the short term and even when to shut down a plant. When the manufacturing line turns on equipment and ramps up production, it begins to consume energy. When it’s time to wrap up production and shut everything down, utilities are often no longer consumed. As a company strives to produce more output, it is likely this additional effort will require additional power or energy, resulting in increased variable utility costs. These employees will receive the same amount of compensation regardless of the number of units produced. For others who are tied to an hourly job, putting in more direct labor hours results in a higher paycheck.

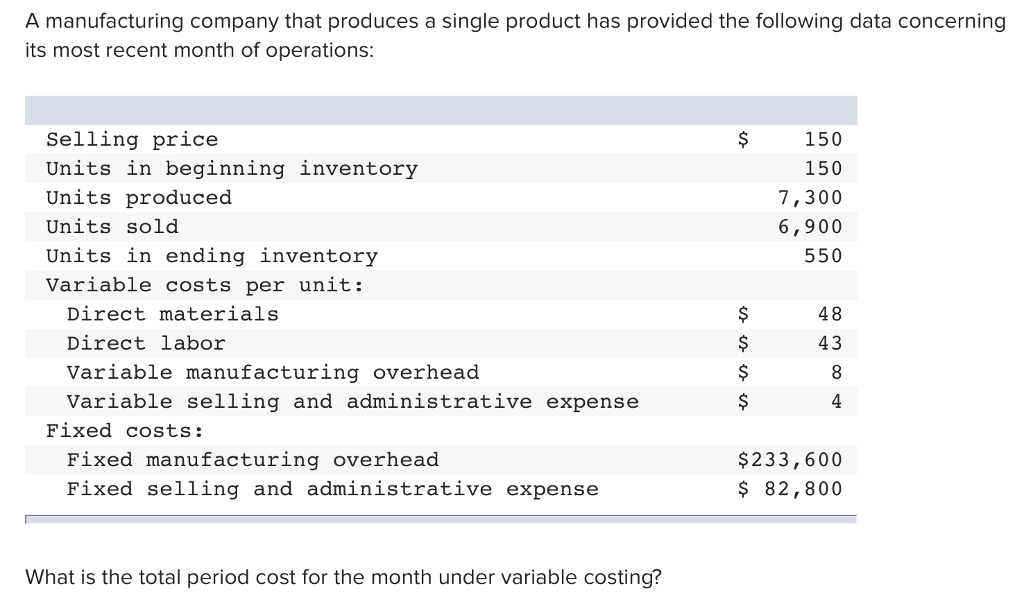

These costs vary depending on the quantity of goods or services produced by a company. By calculating and analyzing variable costs, businesses can make better-informed decisions on pricing, production levels, and overall cost management strategies. Fixed costs are expenses that are direct materials variable costs remain constant, regardless of the level of production or sales volume, while variable costs change in proportion to production or sales levels. Fixed costs typically include rent, salaries, and insurance, whereas variable costs include direct labor, materials, and commissions.